Overview of Public Limited Company Registration

Public limited companies enjoy all the rights of a corporate entity with limited liabilities and it is an ideal choice for the small and medium scale enterprises who wish to raise the equity capital from the general public.

Below we are going to provide full knowledge of the features, procedure and document requirement for Public Company Registration.

Basic Clarification on Incorporation of Public Limited Company

Just like other companies, Public Limited Company is also registered as per the rules and regulations of the Companies Act, 2013. A public Company enjoys the benefits of limited liabilities for its members and has rights to sell its shares for raising the capital of the company. It can be incorporated with a minimum number of three directors and has more stringent rules and regulations as compared to a Pvt. Ltd. Company.

It must have a minimum number of seven members whereas there is no limit for the maximum number of members. It provides all the benefits of a private limited company along with more transparency and easy transferability of ownership and shareholding. Name, shares, formation, number of members, management and directors, etc differentiates any Public limited company from the private limited companies.

Public Limited Company Registration

Documents Required for Public Limited Company Registration

An applicant has to collect all these documents to file along with the incorporation application:

- Identity Proof such as Aadhar card, PAN card, Driving License, Voter Id of all the designated directors and shareholders.

- Address Proof of all the proposed directors and shareholder of the company.

- PAN card details of all the directors and shareholders

- Utility bill such as telephone, gas, water or electricity bill of the registered office as a residential proof of the business place. It should not be older than 2 months.

- An NOC or No Objection Certificate from the landlord of the business place.

- DSC or Digital Signature Certificate of the designated directors

- Memorandum of Association (MOA) and Article of Association (AOA)

Features of Public Limited Company Registration

Here are some important features of Public Limited Company:

- Number of Directors in the company

As stated in the provisions of Companies Act, a public company must have a minimum number of 3 directors to incorporate a company whereas there is no restriction on the maximum number of directors.

-

Name of the Company

All the Public limited companies must add “Limited” word at the end of their name. it is denoted as an identity of a public company.

-

Prospectus of the Company

Prospectus of the company is mandatory for the public limited companies. It is issued by the proposed company for its general public. It is a note of comprehensive statements of works and affairs of the company. However private companies have no such compliances as they don’t have rights to invite the public for their shares.

-

Paid-up Capital

As per the requirements of the act, no minimum capital required for the registration.

What is the difference between the Public limited Company and Private Limited Company?

There are various points of differences between both these companies. Here are some chief differences between both:

|

Point of difference |

Public Limited Company |

Private Limited Company |

|

Members |

Minimum: 7 Maximum: No Limit |

Minimum: 2 Maximum: 200 |

|

Directors |

Minimum: 3 |

Minimum: 2

|

|

Public invitations |

Yes |

No |

|

Minimum Capital Income |

No |

No |

|

Issuance of Prospectus |

Required |

Not Required |

|

Name differences |

Must have “Limited” at the end of its name |

Must have PVT LTD at the end of its name |

|

Mandatory Statutory Meeting |

Yes |

No |

|

Managerial Remunerations |

There are no as such restrictions |

Cannot exceed the limit of 11/% of the net profit |

|

Stock Exchange |

Is listed on stock exchange and stock trade is carried out publicly. |

Not listed on stock exchange neither carry out stock trade publicly. |

Benefits of Public Limited Company Registration

Here are the benefits provided to the company with Public Limited company registration

-

Limited liabilities for the shareholders of the company

Shareholders of the public company enjoy the benefits of limited liabilities under which their assets are safe and cannot be used to clear the debts and losses of the company. Despite of it, the shareholders are responsible for their own legal offenses. All the members, directors and shareholders enjoy this right and their assets cannot be seized by any bank, creditors or government bodies.

-

Perpetual Succession

A public limited company is considered as a corporate body that has perpetual succession. Means in case of death, retirement, insanity, and insolvency of one or more members/ shareholder/ directors, the company still continue its existence.

-

Improved capital of the company

In a public limited company, the general public is invited to buy the shares of the company. Hence, anyone can invest in a public company that improves the capital of the proposed company.

-

Borrowing Capacity

A public company can enjoy unlimited sources for borrowing funds. It can issue equity, debentures and can accept the deposits from the general public by selling its shares. Moreover, most of the financial institutions find public companies more prominent than other unregistered companies.

-

Fewer risks

Since public companies can sell their shares to the public, it lesser the scope of unsystematic risks of the market.

Better opportunities for growth and expansion of the company:

-

Fewer risks lead to better opportunities so that the company can grow and expand by investing in new projects from the funds raised by selling its shares in the market.

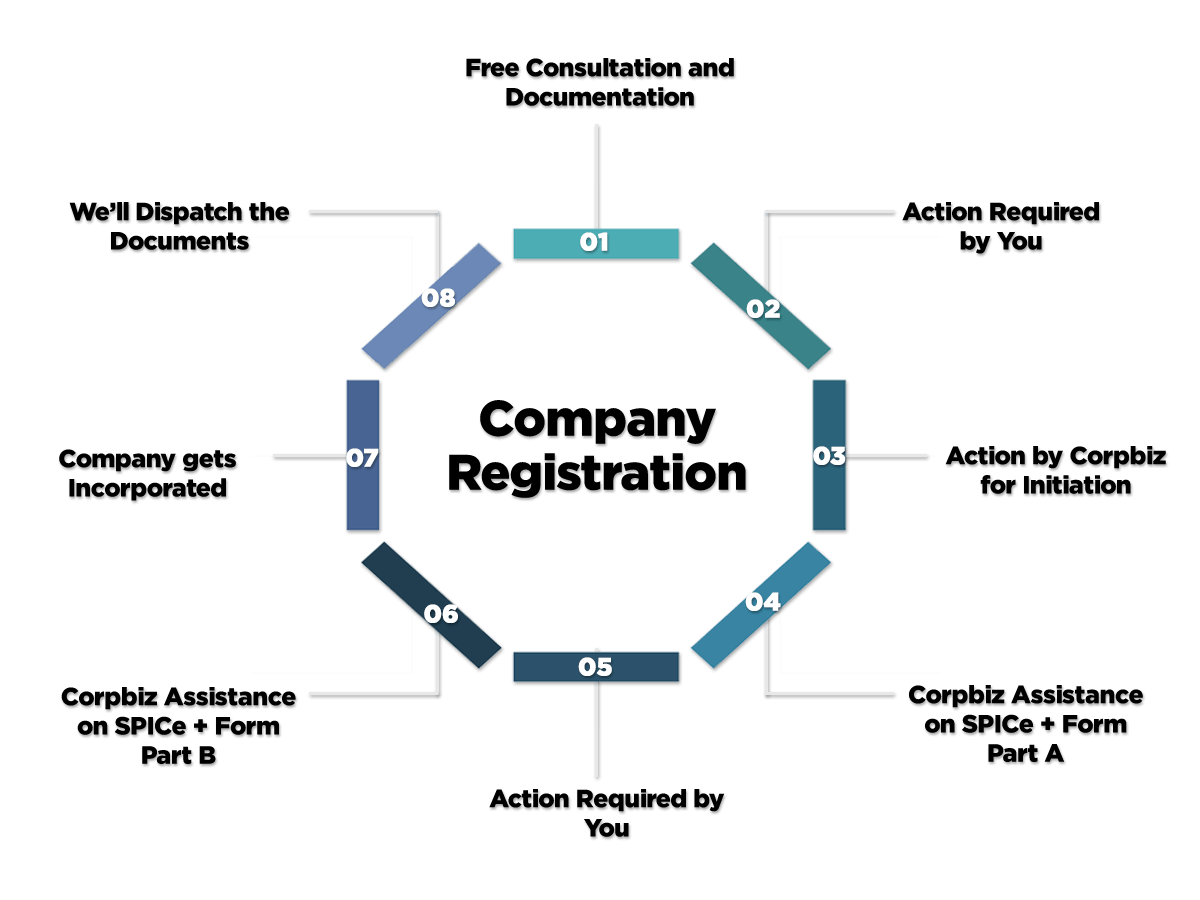

Public Limited Company Registration Procedure

-

Step 1: Apply for the Digital Signature Certificate

First of all, you have to apply for the Digital Signature Certificate for all the proposed directors in the company. DSC is used to sign the e-forms and is an authentic and safe method to file all the documents on an electronic platform. It is a mandatory document.

A director can easily obtain DSC from the nearest Certifying Authorities or CAs with self-attested coppices of their identity proof. It takes around 1 -3 working days to obtain a DSC.

-

Step 2: Name Verification

The third step involves name registration of the company. You can check the name availability through the MCA portal by following this step

Visit the MCA Portal> select the MCA services> Click Check Company Name

Note: The company name should not be taken or registered and should not be similar to a brand name.

-

Step 3: Filing Form SPICe+

Once the company’s name has been approved you can now file the SPICe+ form to avail the company incorporation certificate. Along with it, you have to file all the required documents such as MOA (Memorandum of Association) and AOA (Article of Association). These two documents contain the details of the mission, objectives, aims, visions, business activities, responsibilities of all the directors and shareholders and definition of the proposed company.

All the documents and applications are further verified by the higher authorities and it takes around 7 to 9 working days.

-

Step 4: Obtaining Certificate of Incorporation

Once all the applications and document to have been received to the authorities and they have verified it, the company would receive the Certificate of Incorporation which will include CIN and date of incorporation.

Requirements for the Public Company Registration

According to the provisions of Companies Act, 2013 here are the requirements you need to fulfill to incorporate a Public company in India:

- The proposed company must have a minimum number of 7 shareholders

- The proposed company must have a minimum number of 3 directors

- No minimum capital required

- At least one director should have a Digital Signature Certificate

- Memorandum of Association and Article of Association.

- After approval from Registrar of the Companies, the proposed public company has to apply for the “Certificate of Business Commencement.”

Frequently Asked Questions

AOA is abbreviated as the Article of Association. It defines the internal constitution of the company while MOA (Memorandum of Association) represents the mission, vision, and business object of the company before its incorporation.

DSC is abbreviated as the Digital Signature Certificate, which is issued by the certifying authority to sign the electronic documents. DIN is the Director Identification Number which is allocated along with the Certificate of Incorporation through SPICe+ form.

It generally takes 15 business days to register a public limited Company.

The registration is valid throughout the life of a company.

Public Limited Company is the best option for entrepreneurs who concedes larger investment requirements for the business.

In case of any losses, only the investment in shares of the business gets lost in virtue of Public limited company, where personal assets of the directors are meant to be safe.

Any Public Limited company can list itself in a variety of stock exchanges in India and raise capital from stock market itself.

For setting up a public limited company anywhere in India, there are a lot of primary requirements which are needed to be taken care of while optioning for the Registration of the same. Kindly refer the above mentioned text for your better understanding and knowledge.

The primary requirement of the minimum paid-up share capital worth INR 5 Lac has been repealed by the famous amendment done via Companies (Amendment) Act, 2015.

Public limited company has to deal with heavy compliances strictly as they generally deal with public money, which are bulkier than those performed by a private limited company in India. There are much periodic & annual compliance to be made by a public limited company with ROC/MCA, RBI, SEBI, etc apart from the regular compliances concerned with income tax. These regulatory authoritative liabilities are in addition to promote and secure steadily along with the welfare and profits of all shareholders of the public limited company in India.

It is true that a Foreign National or NRI can also be a shareholder or director in a public limited company, for which he must fulfill the basic requirement to possess the DIN issued by MCA along being a sensible person of any society.