An Overview of Company Registration in India

To incorporate a private company minimum of two members is required, and the maximum limit of members is 200 as per the 2013 Act. If any private limited company faces financial risk, its shareholders are not subject to selling their personal assets, i.e., they ought to have limited liability. A private limited company has continuous existence. A private limited company holds on existing even in the case of death or bankruptcy of its members.

For online company registration, there must be a least two directors, while a maximum of 15 directors can be appointed in a company. The proposed director must be of 18 years of age. A foreign national can also become the director of any private limited Company in India. There is no minimum paid-up capital required for private limited company registration. Every private limited company must use "Pvt.Ltd." after their name.

The private limited company does not have any relationship with the public; they aren't allowed to ask for any collateral from any public or public sectors. In a private limited company, individuals are not liable to transfer shares, which protects takeovers of private limited companies from big enterprises.

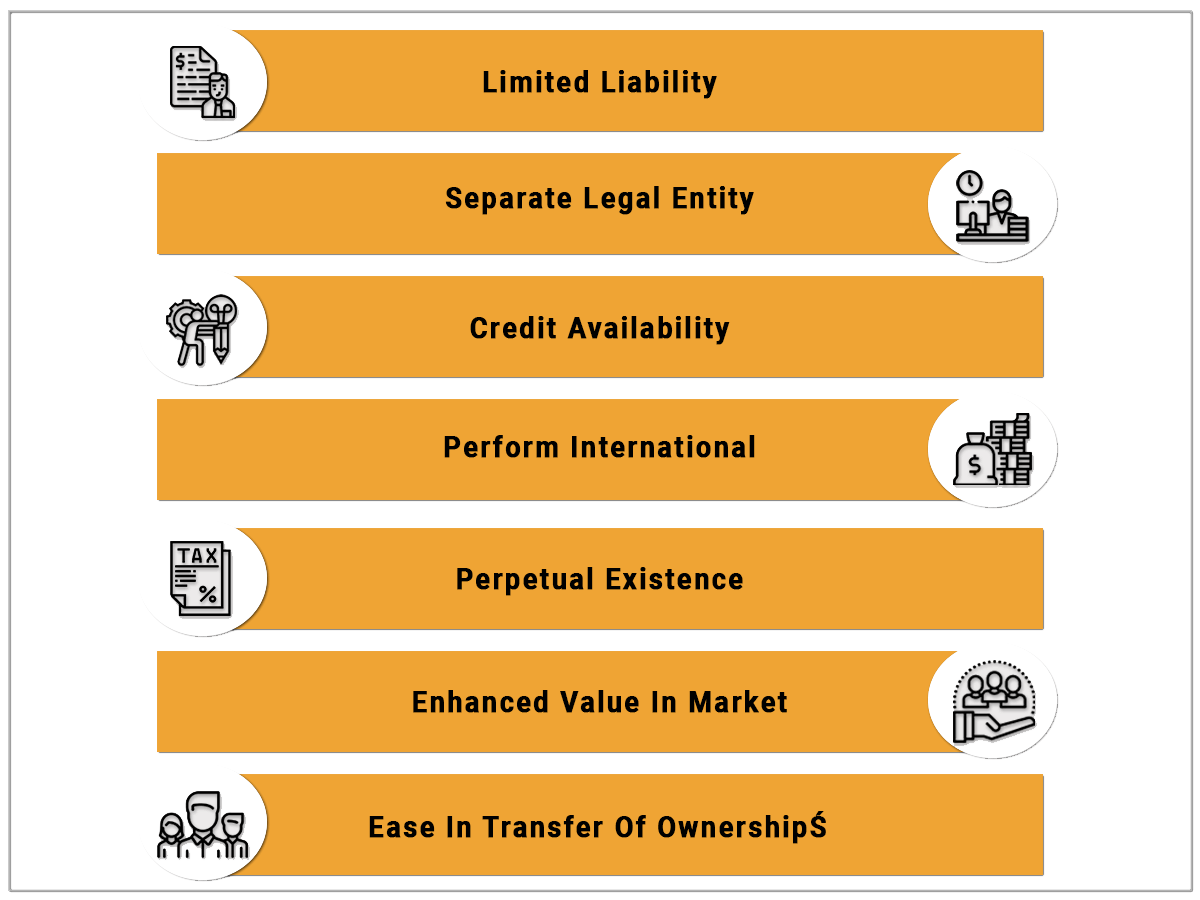

Benefits of Private Limited Company Registration in India

Starting a private limited company offers many advantages such as:

Now, let's discuss some of the benefits in detail;

- Limited Liability

The responsibility of the members of a private limited company is restricted to their share only as the private limited company is a separate legal entity.

- Separate Legal Entity

A private limited company is a separate legal entity that possesses all the rights to sue or to be sued. It acts as an artificial person who can buy a property in its own name.

- Credit Availability

A private limited company can obtain funds from the debentures as well as the stockholders. Registered Private Limited Company is considered a corporate entity that attracts different angel investors and venture capitalists that helps them to expand and raise their funds for the growth of their business and company.

- Perform Internationally

The private limited companies support Foreign Direct Investment, in which another type of firm requires appropriate licensing and approval from the administration for foreign investments.

- Perpetual Existence

A private company has a lifelong existence. Private limited companies are considered separate legal entities and are separate from the existence of their owners. It means they cannot be dissolved or end because of the death, retirement or insanity of any of their members/directors/shareholders.

- Enhanced Value in Market

A registered private limited company is considered more trustworthy than a non-registered one. Information regarding the Registration of a private limited company can easily be obtained from the website of the Ministry of Corporate Affairs. Vendors, suppliers and investors trust them over the other business structures. As a result, it enhances the brand value of the company amongst the customers and other investors and suppliers.

- Ease In Transfer of Ownership

It is quite easy to transfer equity to new members and issue fresh shares in a private company.

Basic requirements of Online Company Registration

There are a few requirements to be known before initiating a Private Limited Company in India:

- The private limited company must have a unique name which should not be the same as any other registered company and trademark.

- It is mandatory for a private limited company to have a minimum of two directors.

- As well as, it is necessary to keep in mind that the private limited company should have a minimum of two shareholders.

- All directors & members of a private limited company should have a digital signature certificate which will be used to register a private limited company.

- There is no minimum capital required for initiating a private limited company.

- The process of online company registration is quite simple; make sure that you have a unique name for your company which will surely help you with quick company registration.

- You must avoid any offensive name for your private limited company registration.

A private company may be formed as per section 3 of the 2013 Act by two or more persons by giving their names and complying with the requirement of the registration process given under the provisions of the said Act.

The following documents and information are required to be filled with the registrar within whose jurisdiction the registered office of the registering company is situated:

- The memorandum and articles are duly signed by all the subscribers of the memorandum in the prescribed manner.

- A declaration by the advocate, chartered accountant, cost accountant or company secretary in a prescribed manner who are engaged in the incorporation of the company and also by the persons named in the articles of the company as a director, manager or secretary of the company that all the requirements of Registration prescribed under the Act are complied with.

- An affidavit from each subscriber to the MOA and the person named as the first director in the AOA of the company that he is not convicted for any offence related to the formation, management and promotion of the company and has never been guilty of fraud or a breach of the company.

Company Registration Filing Form - Manual to New Web-based SPICe + Form

SPICe Plus serves many requirements like name reservation, incorporation, DIN allotment, issue of PAN, TAN, EPFO, ESIC, Profession Tax (Maharashtra) and Opening of Bank Account. Moreover, one can also acquire the GSTIN via SPICe + form.

Part A:

Name Reservation:

The application for name reservation should be made online by using Reserve Using Name (RUN)

Part B:

- Company Incorporation

- Application for DIN

- PAN Application

- TAN Application

- GSTIN Application

- EPFO Registration

- ESIC Registration

- Opening of Bank Account for the Company

- Profession Tax Registration (only for Maharashtra)

Declaration

The declaration in form 'INC-9' of the subscribers and the directors must get auto-generated in PDF format and presented electronically. The aspirant has to provide the recommendation along with a certification recommended by a professional, such as Company Secretary, Chartered Accountant and Cost Accountant.

Documents for Online Company Registration

- The Articles of Association

- Memorandum of Association

- Declaration by the subscribers and by the directors

- A confirmation for the address of the office

- Two months utility bills copy

- Certificate of incorporation of the Outer Country body corporate [If applicable]

- A resolution passed by the global Company [If applicable]

- A recommendation declared by the promotional Company [If applicable]

- The interest of the directors from other entities [If applicable]

- Nominee’s assent

- Identity proof and residential address of the subscribers and the nominees

- Identity proof and residential address of Applicants

- The Declaration/Resolution of the unregistered companies

- DSC (Digital Signature Certificate)

- Any other document [If required]

For AGILE-PRO:

- Proof of principal place of business

- Evidence of appointment of Authorized Signatory for GSTIN

- Either of the documents– Letter of Authorization/Copy of Resolution passed by BOD

- Managing Committee and Acceptance Letter

- Proof of identity of Authorized Signatory for the opening of a bank account

- Proof of address of Authorized Signatory for the opening of a bank account

- Specimen Signature of Authorized Signatory for EPFO

Declaration

The declaration in form 'INC-9' of the subscribers and the directors must get auto-generated in PDF format and presented electronically. The aspirant has to provide the recommendation along with a certification recommended by a professional, such as Company Secretary, Chartered Accountant and Cost Accountant.

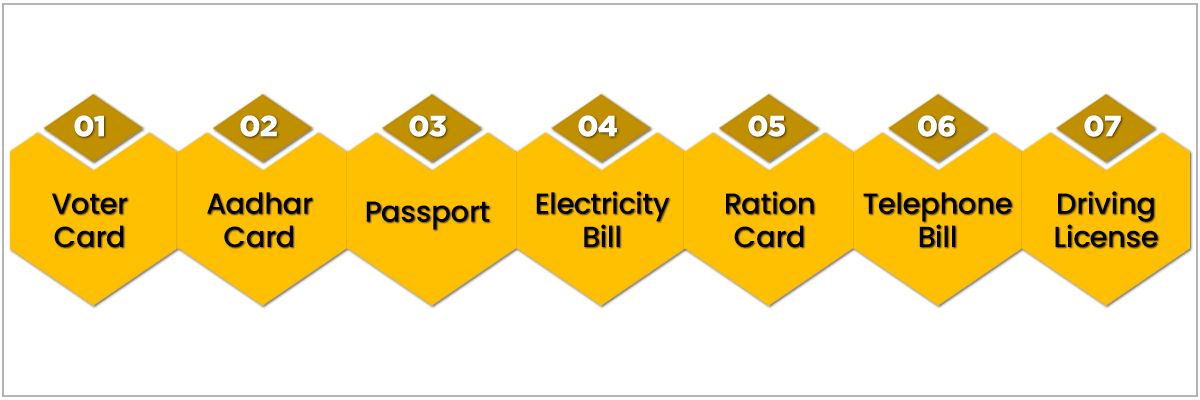

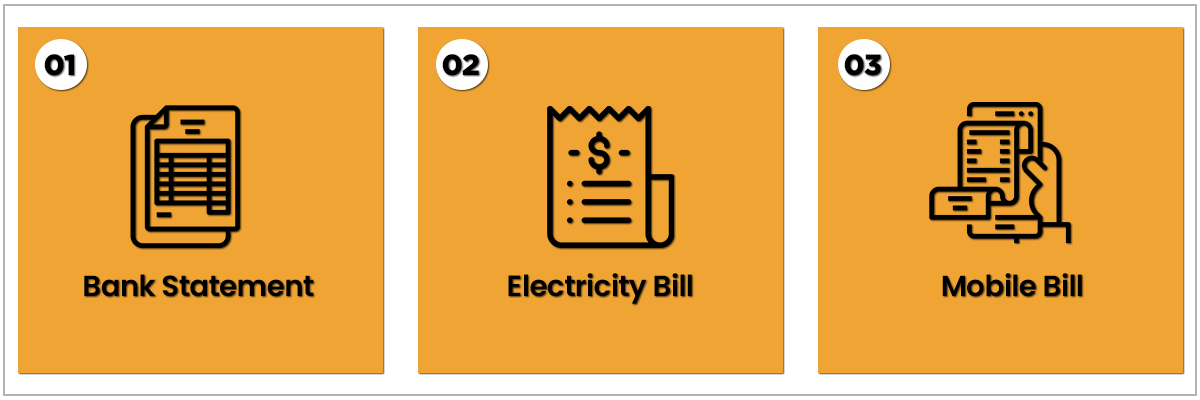

Documents That Can Be Used as Address Proof

Documents That Can Be Used as a Residential Proof

List of assistance which will be offered by the Online Company Incorporation Form i.e SPICe+ form:

- Director Identification Number (DIN) Allotment

- Incorporation of Company

- PAN Issuance for the Company

- Issue of TAN

- Registration of Company as an Employer with EPFO

- ESIC Registration for the Company

- Profession Tax Registration for the State of Maharashtra

- Bank Account Opening.

- Company Registration as Tax Payer in GST

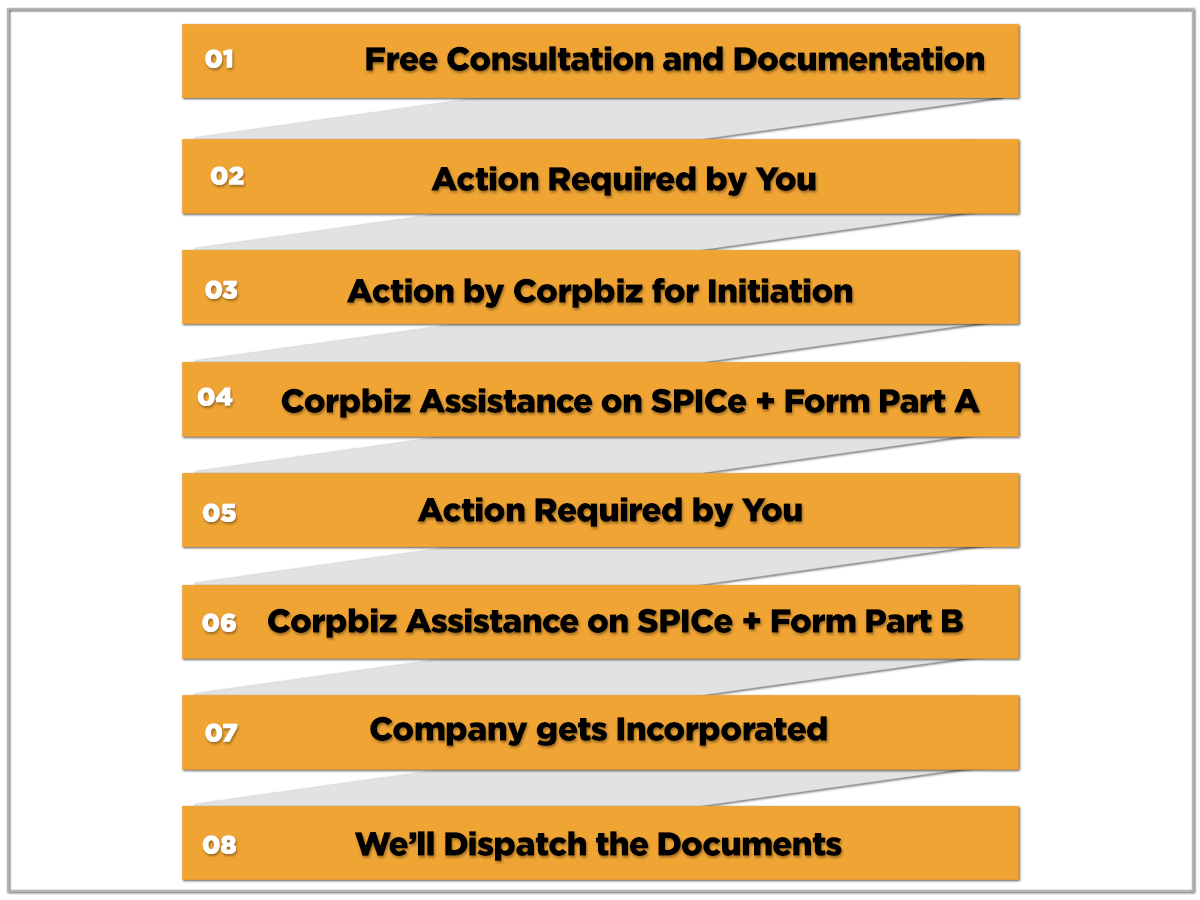

Procedure for Company Registration Online

SPICe+ form is said to dedicate ten services via three central govt ministries and departments, which are the Ministry of Labour & Department of Revenue, Ministry of Finance and Ministry of Corporate Affairs. The new SPICe Plus form is said to save time and has been incorporated for all the new companies from February 23. The other forms that need to be filed along with SPICe+ are AGILE-PRO, SPICe+AoA and SPICe+MoA.

- Click 'SPICe+' placed under 'MCA Services'.

- After that, Choose' New Application;

- For existing applications, you can prefer 'Existing Application', fill in the application number with the proposed or approved name. Click 'Type of Company'

- Click 'Class of Company' and the 'Category of Company"

- Click 'Sub-Category of Company'

- Next, you have to specify the 'Main division of industrial activity of the Company.'

- Next, you have to mention the 'Main division of industrial activity of the Company.'

- Next, you have to provide details of the 'proposed or approved name'. Click the 'Auto-check' in accordance with the rules administering the name. Submit the 'Part A' for reservation of name or proceed with the incorporation.

- Part B has different sections for 'check form' for each section. The details required for Registration are as follows:

- Location of the registered office of the Company

- Proposed directors and subscribers

- Resources of the Company

- Apply for tax registrations such as PAN and TAN

- Carry out a 'pre-scrutiny' check. A confirmation is presented upon successful submission of the form.

- Download the PDF of Part B proposed for affixing the DSC and for filling up any linked forms along with Part B. The forms linked to SPICe+ are AGILE-PRO, SPICe+MoA and SPICe+AoA, URC-1 and INC-9. Part B of SPICe+ and linked forms can then be uploaded to the MCA portal. A Service Request Number is generated for making a payment towards private limited company incorporation. Once the payment is made successfully, the forms will be processed.

- In a case where the forms need resubmission for any errors being flagged upon processing, the SPICe+ form has to be resubmitted in the same manner.

MOA and AOA of a Company

Companies are governed by legal documents which contain dos and don'ts for it. These are known as MOA and AOA, which states the company's scope of work and internal management. In simple words, they are the constitution of the company. They safeguard and structure the business of the company and establish the identity, goal and methodology of the company.

The MOA and AOA are filed with the registrar of the company along with the incorporation form of the company. These are indispensable, and the foundation of the company stands on them only.

Memorandum of Association (MOA)

MOA contains the details of the constitution of the company, and it is the foundation of the company's structure. It is called the charter of the company as it lays down the objective and scope of the company. At the time of incorporation of the company, its members must put a signature on the MOA of the Company as attestation or approval of its content, which means members must subscribe to the MOA.

Contents of MOA:

- Name Clause: The name of the company must be there with the ending as "Pvt.Ltd." in the case of a private company and "ltd." In the case of a public company. The name should be unique and not identical to any existing company. It should not indicate any connection with the government or any local authority.

- Situation Clause: The state in which the company has its registered office. Within 15 days of incorporation, the company must have its registered office, and its address should be written outside of each office of the company.

- Object Clause: It should state the purpose of the company, and it cannot be changed in future. The company cannot act beyond what is written here; otherwise, it will be said to be ultra-virus and will be void ab-initio.

- Liability Clause: The liability of the members of the company should be stated in it whether it is limited by guarantee or shares or unlimited. A company cannot increase the liability of any member without his written consent.

- Capital Clause: The amount of share capital should be written with which the company is going to be registered. This will state the maximum amount of the shares.

- Subscription Clause: It has all details of subscribers. These subscribers have to take at least one share, and each of them will write the number of shares he is going to take.

Articles of Association (AOA)

The bye-laws, rules and regulations will govern and control the management of the company and conduct its business. AOA is part of the MOA and is governed by the MOA of the Company.

It is a secondary document that has the company's internal working, rights, duties, rules, laws and management. The companies have the power to alter their AOA, and this alteration must be passed by a special resolution.

Contents of AOA

- Details of shares

- Details of Directors

- Rules regarding company dividends and returns

- Rules regarding company accounts and audit

- Company's browsing power

- Meetings of Company

- Winding up of Company

Difference between MOA and AOA

|

MOA |

AOA |

|

Constitution of company |

Set of rules, regulations and laws governing the working of company |

|

Defines objective and scope of company |

Describes powers, rights, duties and liabilities of members of company |

|

Must have mandatory six clauses |

Contents are as per the requirements of the company |

|

Most important and supreme document of company |

Part or subordinate of MOA of company |

|

Helps and guides the drafting of AOA |

If it contradicts MOA, then considered null and void. |

|

It cannot be altered unless passed in a special resolution in Annual General Meeting and after obtaining prior approval from the government of India |

Can be altered as per provisions of Companies Act after passed by special resolution in Annual General Meeting |

|

Cannot be amended |

Can be amended retrospectively |

|

Defines relationship of company with outer world |

Defines relationship of company with its members |

|

Any act done beyond its scope is ultra-vires and void which cannot be rectified |

Any act done beyond its scope is ultra-vires and can be rectified by shareholders by a special resolution |

Importance of choosing the right business structure

At the time of starting a business, many decisions are needed to be made, but the most important is to choose an appropriate business structure. The first thing one should consider is what form of entity is best suitable for business. All these forms of the entity have their own pros and cons. Here are some pros and cons you should discuss with your business attorney:

- Limited liability

- Legal paperwork, especially written agreements

- Taxes treatment

- Personal Liability

- Industry

- Flexibility

- Complexity

- Control

- License, permits and regulations

Each business structure has different advantages, but one must choose accordingly. One should choose the right business structure based on the local laws and the company's goal. With time one can change their business form also, like from sole proprietor to limited liability company.

In the beginning, a start-up should mostly consider its goal, financial conditions and financial needs, risk and ability to grow in the business. Each place has different requirements for different business structures, and depending on where you set up your business; there could be different requirements.

Business structure comparison

|

Particulars |

Private Company |

Public Company |

Limited Liability Partnership |

|

Minimum Capital |

No minimum capital required |

5 Lakh |

No minimum capital required |

|

Minimum number of members |

2 |

7 |

2 (minimum 2 designated partner/partner) |

|

Minimum number of directors |

2 |

3 |

2 (minimum 2 designated partner) |

|

Compliance |

Less compliance than public company |

More compliance |

Less compliance |

|

At the end of the name |

Pvt Ltd. |

Ltd. |

LLP |

Capital Structure of Company

A company's capital structure mainly falls under these:

- Authorized Share Capital

The authorized share capital is a part of the MOA of the Company under the capital clause. The amount is generally decided before the incorporation of the company; however, the companies have options to raise this authorized share capital in future.

- Paid-up Share Capital

The paid-up share capital is the amount for which the company issued shares to shareholders after they have made payments to the company. The paid-up capital of a company is always less than or equal to the authorized share capital. Such amount should be deposited in the company's account within 30 days of allotment of shares. After the Companies Amendment Act 2015, there is no minimum paid-up capital for private companies.

This is how we can help you with Private Limited Company Registration:

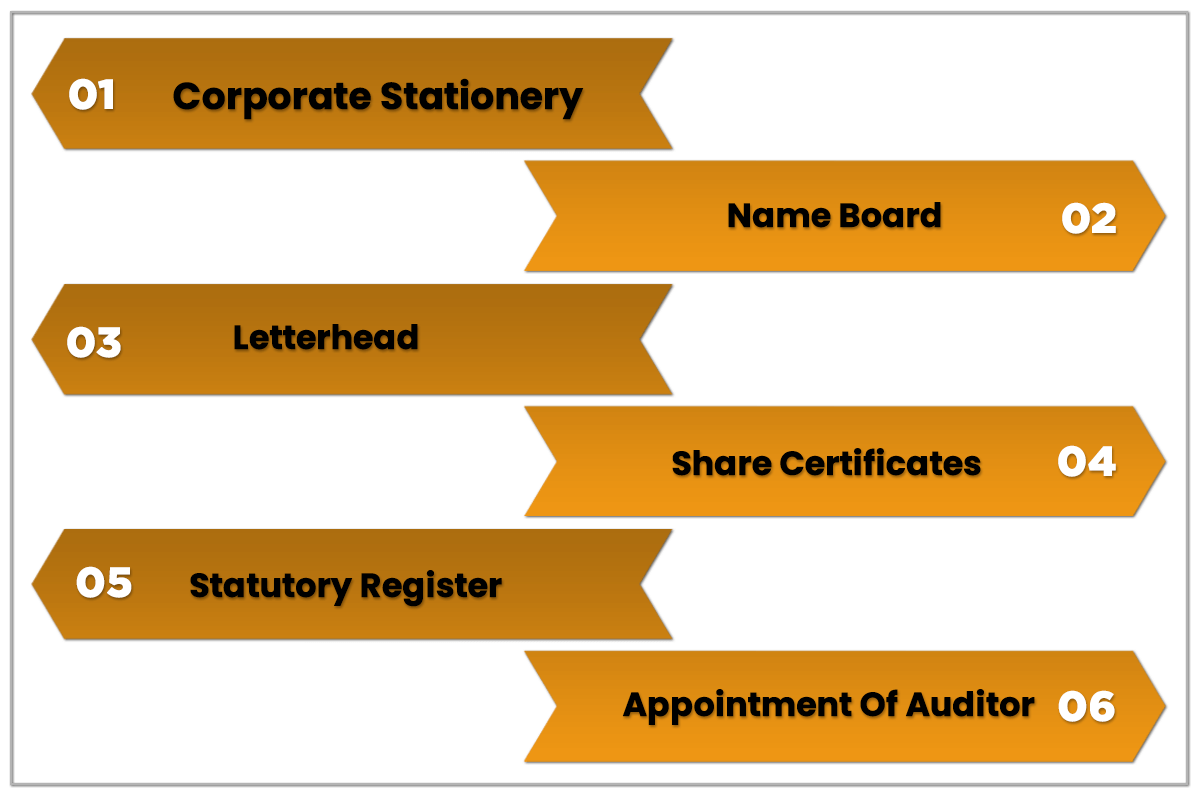

Post Private Limited Company Incorporation Formalities

- Corporate Stationery

The company must obtain the corporate staffs to use in company compliance matters.

- Name Board

Companies are required to affix the name of the company and the location of its registered office outside each office.

- Letterhead

Companies must publish the name and registered office address of the company on all letterhead, receipts, announcements and other official records of the company.

- Share Certificates

Companies must address share certificates to all the contributors within two months from the date of establishment.

- Statutory Register

All companies need to maintain a statutory register company containing information like a register of members, a list of directors, charges, debentures and other matters about the shareholders and administration of the company.

- Appointment Of Auditor

Subsequent to company incorporation, it requires the Board of Directors to designate the first auditor of the company, a Chartered Accountant, within 30 days of incorporation.

Business Entities Comparison Guide

Proprietorship

- A maximum of 1 member is needed;

- The entity is not considered a separate legal entity;

- The liability of members is unlimited;

- The Registration of an entity is not compulsory;

- The transferability option is only for an individual;

- The profit and losses of the business should be reported in the personal income tax return of the sole proprietor. The business itself is not taxed.

- The Income Tax Return is filed with the Registrar of Companies.

Partnership Firm

- A minimum of 2 and a maximum of 20 members are needed;

- The entity is not considered a separate legal entity;

- The liability of members is unlimited;

- The Registration of an entity is optional. The entity can be registered under the Partnership Act, 1932

- The transferability option is available only for up to 30% of the Company's profit only.

- The Partnership Firm is liable to pay income tax at the rate of 30% of Company profit.

- The Income Tax Return is filed with the Registrar of Companies.

LLP

- A minimum of 2 members are needed. There is no limit on the maximum number of members;

- The entity is considered a separate legal entity;

- The liability of members is limited;

- The Registration of an entity is done under MCA;

- The transferability option of LLP is 30% of Profit Plus CESS and Surcharges applicable;

- The LLP is liable to pay income tax at the rate of 30% of Profit Plus CESS and Surcharges applicable;

- The Income Tax Return is filed with the Registrar of Companies.

Private Company

- A minimum of 2 and a maximum of 200 members are needed;

- The entity is considered a separate legal entity;

- The liability of members is limited to the extent of share capital;

- The Registration of an entity is done under MCA.

- The transferability option of Private Company LLP is 30% of Profit Plus CESS and Surcharges applicable;

- A Private Company is liable to pay income tax at the rate of 30% of Profit Plus CESS and Surcharges applicable.

- The Income Tax Return is filed with the Registrar of Companies.

OPC

- Only one member is needed;

- The entity is considered a separate legal entity;

- The liability of members is limited to the extent of share capital;

- The Registration of an entity is under MCA and Companies Act, 2013;

- The transfer of OPC is allowed to only one person;

- An OPC is liable to pay income tax at the rate of 30% of Profit Plus CESS and Surcharges applicable.

- The Income Tax Return is filed with the Registrar of Companies.

Frequently Asked Questions

SPICe is an e-form and SPICe+ is an integrated Web form providing ten services by 3 Central Govt. Ministries & Departments.

Application Number refers to a system-generated number given to an applicant for Name reservation/Company Incorporation.

Yes. However, a fee of INR 1000 becomes payable if applied separately.

Yes. Registration for EPFO and ESIC will be necessary for all new companies incorporated w.e.f 23rd February 2020 and no EPFO & ESIC certification will be separately issued by the respective centres.

Presently ICICI bank has been integrated with SPICe+ for opening a Bank account.

To ensure that the size of the copied PDF document is within the permissible size limits, it is advised that scanning should be done in 'black-white' mode at 200 dpi resolutions.

Use of Debit Cards/ Credit cards and Internet Banking is the most prevalent. It is an entirely secure process.

The process of e-Filing is entirely secure. Online Inspection of documents is allowed strictly by the provisions of the Companies Act, 2013 on payment of a prescribed fee.

Once filed, the e-Form cannot be rectified. You may, however, re-submit the e-Form, if the concerned MCA office has marked the status of your SRN as 'Re-submission'.

A Private Limited Company cannot float shares to the general public.